To run simulations for your scenario, click this button and you will be take to our calculator for 08-14 Borrowers.

More than any other group of borrowers, this one is most affected by the recent legislation. If you were part of this group and using an income-driven repayment plan, you were most likely on Pay As You Earn (PAYE), which is scheduled to be phased out July 1, 2028.

What's PAYE...

If you took out graduate student loans after October 1, 2007 but before July 1, 2014—there’s a good chance you’ve been riding the PAYE train for a while now.

And for good reason. PAYE has been one of the most generous income-driven repayment (IDR) plans available:

But all of that is changing.

As of July 4, 2025, a new law—H.R. 1, nicknamed the “One Big Beautiful Bill Act”—is officially phasing out the PAYE plan. And no group is more affected than borrowers like you.

What’s Changing?

Let’s start with the basics: PAYE is going away—but not immediately. The plan will be sunset on July 1, 2028. Until then, you can stay in it. After that, you’ll have to switch to either Old IBR or the new RAP (Repayment Assistance Plan).

This change wasn’t originally expected. A last-minute maneuver in the Senate allowed the bill to bypass procedural obstacles, but it delayed the full phaseout to 2028. So you’ve got some time—but don’t wait until the last minute.

Your New Repayment Options

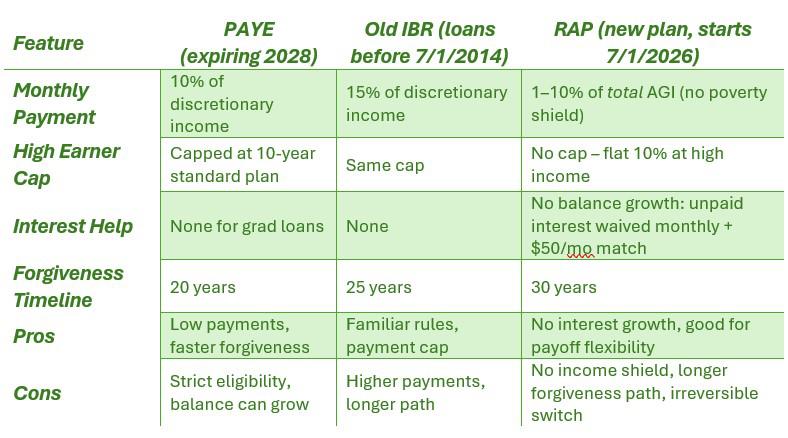

Here’s a breakdown of how the available repayment plans stack up for graduate borrowers:

What This Means for You

Before July 1, 2028, you’ll need to pick a new path. Here's the rundown:

Option 1: Switch to IBR

Option 2: Switch to RAP